South West Indian Ocean Investment Portfolio

South West Indian Ocean Investment Portfolio

The South West Indian Ocean continues to battle development challenges including high levels of absolute poverty, a youth bulge in search of formal employment, prevalent informality in the economy, overdependence on exports for primary commodities, persistent income inequalities, and deficient inland-based infrastructure. These challenges are being compounded by the ongoing COVID-19 pandemic.

This portfolio focuses on five countries in the South West Indian Ocean - Mozambique, Kenya, Tanzania, South Africa and Madagascar.

The annual “gross marine product” of the Western Indian Ocean region – equivalent to a country’s annual gross domestic product (GDP) – is at least US$20.8 billion. The region’s total ocean asset base is conservatively estimated to be at least

US$333.8 billion.

These values are derived from direct outputs from the ocean (e.g. fisheries), services supported by the ocean (e.g. marine tourism) and adjacent benefits associated with the coastlines (e.g. carbon sequestration). Several of the countries of the South West Indian Ocean are among the poorest in the world, the ocean’s contribution is significant toward alleviating poverty. Of critical importance, for example, are the food and livelihood benefits that the ocean provides but which are not captured in conventional economic analysis.

Kenya and Tanzania

lost about

lost about

%

of their mangroves over 25 years, and Mozambique lost

%

Valuable coastal ecosystems are being degraded.

Much of this value is concentrated on the coasts, assets that we’re now rapidly eroding so much so that we have already lost half of our coral reefs and mangroves over the last 30 years due to overharvesting, climate change induced coral bleaching, pollution, acidifying seas, sedimentation, and changes in river flow. For example, mangrove coverage is diminishing in most countries in the region – Kenya and Tanzania lost about 18 percent of their mangroves over 25 years, and Mozambique lost 27 percent over a shorter timeframe.

Coral reefs, mangroves and seagrass beds are some of the planet’s most productive ecosystems, providing food security, important breeding and feeding grounds for fisheries and other species, protection from storms, economic opportunity and a host of other goods and services.

Coral reefs, mangroves and seagrass beds are some of the planet’s most productive ecosystems, providing food security, important breeding and feeding grounds for fisheries and other species, protection from storms, economic opportunity and a host of other goods and services.

Further, coral reefs are the primary asset for the coastal tourism sector, providing coastal protection, recreation areas and seafood worth US$18.1 billion annually. Tackling climate change is a global challenge, but countries in the region must take urgent action to protect reef health. This includes reversing the rise in those threats under their control, such as destructive fishing and pollution, and taking a proactive approach to improve reef conditions and identify reef-specific management actions and options.

There is a coastal development juggernaut on the horizon.

The case for protecting healthy natural infrastructure, such as reefs and mangroves, is strong and momentum is building for scaled-up intervention. Certainly, from a climate change perspective, UNFCCC so-called ‘Blue CoPs’ in 2019 and 2020 have a substantial focus on oceans and the importance of the ocean’s so-called blue natural capital to achieving climate change mitigation and adaptation. However, conservation efforts are at risk of being undermined, and overtaken by the proposed development on the horizon and projected tens of trillions of investment in heavy infrastructure and exploitation expected in the next decade, much of which will take place on or within reach of the coast. Despite the growing interest in the tremendous investment flows being directed at coastal areas, there remains a lack of understanding

of the extent to which these investments will either support or undermine coastal ecosystems, national priorities and political imperatives. The economic value of coastal protection provided by coral reefs, mangroves and salt marshes in the Western Indian Ocean is estimated at US$1.2 billion annually. As coastal development, urbanization and industrialization progress in the South West Indian Ocean, the value of coastal property and infrastructure will grow rapidly, and the measured economic value of coastal protection will climb accordingly. This will be reflected in a higher gross marine product.

Consequences of the lack of investible sustainable projects.

The lack of investible sustainable projects within the blue economy and inadequate enabling environments also mean that investors and the broader mainstream finance sector continue to adopt conventional approaches to finance, focusing on investments which provide quick wins without considering the long-term consequences for people and the planet.

Location Of Portfolio And Current Investment Opportunities

Mozambique (Priemeras and Segundas, Quirimbas, Inhambane), Madagascar (Ambaro Bay, Kirindy Mite, South of Belo sur Mer, Nosy Hara, Tsiribihina and Manambolo Deltas, Mahafaly seascape), Kenya (Lamu and Shimoni Vanga) and Tanzania (Rumaki seascape), South Africa (Kogelberg; Hamburg).

OPPORTUNITY ANALYSIS

This work has been carried out in partnership with Finance Earth and Ocean Hub Africa.

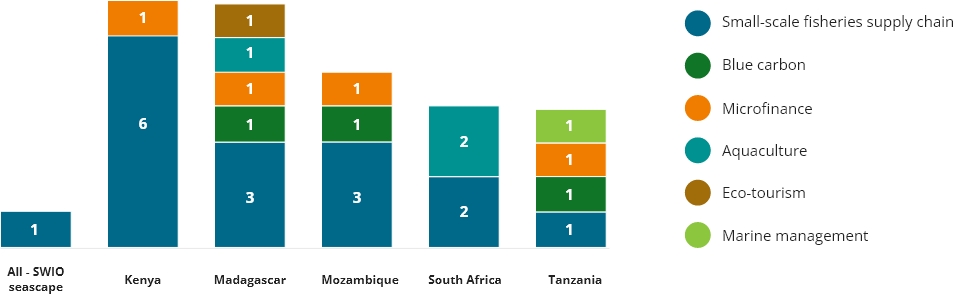

Project theme by location

Variety of themes identified across the seascape demonstrates opportunities for shared and capacity building across the region.

The identified projects can be categorised into six sector themes

Blue Carbon Disaster risk reduction and climate adaptation

Number of projects: 4

Generating saleable carbon credits from mangrove and seagrass protection, restoration, and/or creation, including through sustainable livelihood development.

Aquaculture

Number of projects: 3

Sustainable aquaculture activities, including offshore seaweed production, coastal abalone ranching and onshore kob aquaculture.

Small scale fisheries (SSF) supply chain

Number of projects: 15

Adding value to small-scale fisheries, including shared equipment. infrastructure, and business centres for fishing communities/co-operatives, and development of market channels through technology.

Tourism

Number of projects: 1

Locally managed eco-tourism offering in Madagascar, including community-led accommodation and demonstration activities.

Microfinance

Number of projects: 4

Generating income through the interest payment from loans and saving schemes, which enable coastal communities to invest in sustainable blue economy activities.

Marine Management

Number of projects: 1

The establishment of a marine park, including development and renovation, implementation of demarcated zones, and the training of park management and operational staff.

CURRENT INVESTMENT PIPELINE PER BUSINESS DEVELOPMENT STAGE

To determine the ability of each project to generate financial returns for investors, and additional environmental and social benefits for communities, Finance Earth (add link to their website https://finance.earth/) assessed their potential to be expanded (scaled) beyond their current operational scope within the existing project structure.

Scalability of the project

11 Projects

%

were considered highly scalable,

indicating that their operations could be expanded across a substantially greater area or number of beneficiaries to unlock greater impact.

13 Projects

%

were considered to have medium scalability,

indicating that their operations could be expanded, but only to a limited extent, across a greater area or number of beneficiaries.

2 Projects

%

considered to have low or no scalability,

meaning that their operations were highly site-specific and unlikely to be expanded beyond their existing operations.

2 Projects

%

required further analysis,

to determine their level of scalability.

These results demonstrate that there are significant opportunities to scale existing projects to maximise their benefits beyond their current operational scopes, creating the potential for catalytic investments by helping businesses expand their operations to support more beneficiaries.

Replicability of the business model

To determine the ability of each project to create and prove a business model that could generate long-term, sustainable benefits for investors, the environment and communities, Finance Earth assessed their potential to be replicated in other areas or regions.

26 projects

%

were considered highly replicable,

indicating that these projects could easily be replicated throughout the region or even globally to unlock benefits for the natural environment and coastal communities in other areas and/or for other purposes.

1 project

%

was considered to have low or no replicability,

indicating that this project was highly location-specific and would be impractical or impossible to replicate elsewhere.

1 project

%

required further analysis,

to determine its level of replicability.

These results demonstrate that there are significant opportunities to develop these models to create tested and proven business models that can be learned from and replicated to generate benefits in other areas of the SWIO region and globally.

This Portfolio Will Deliver:

This project was supported by the Ocean Risk and Resilience Action Alliance (ORRAA) and was funded with UK aid from the UK government.