Microfinance

Microfinance

Microfinance

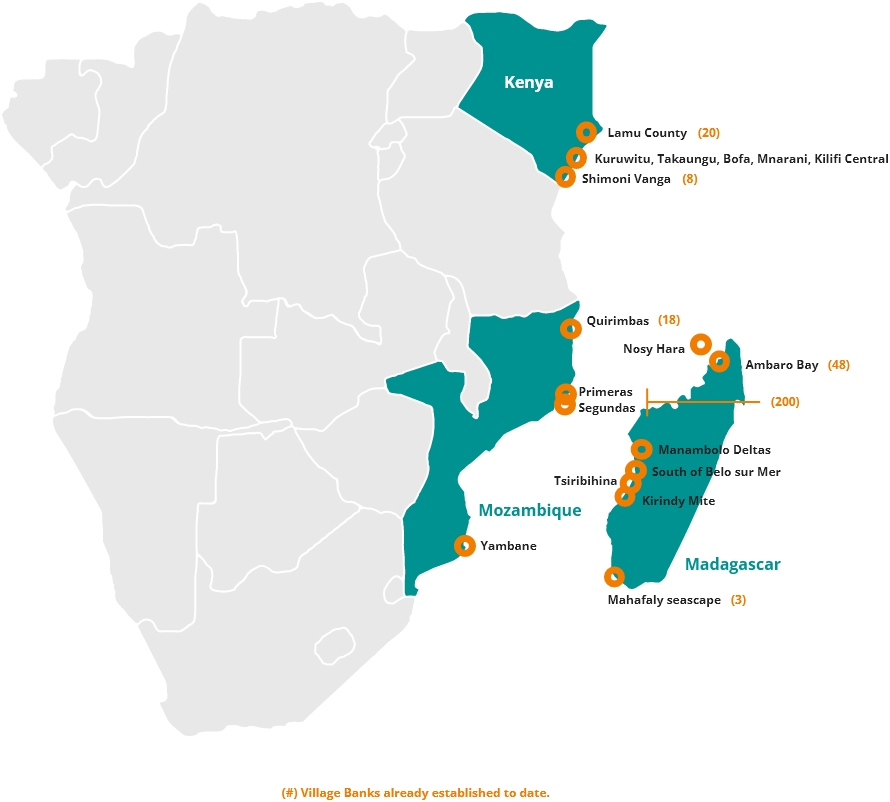

The microfinance facility aims to incentivise sustainable marine activities and increase financial literacy and inclusion, facilitating increased economic resilience in coastal communities.

Collaboration between local stakeholder communities to develop the fisheries supply chain through the establishment of infrastructure and creation of shared resources. With the aim to improve livelihoods through increased revenues, reduced post-catch losses and better resource management.

Stage of development

Feasibility Study.

Revenue streams

Microfinance savings and investments interest.

Beneficiaries

BMUs owned by fishers who get better value for their catch, therefore directly benefiting from the

services. Microfinance services are centralised at BMU level, benefiting the community directly.

Existing partners

PCI Media, Adel Sofala, Kukumbi, Wetland International, Save Our Mangroves Now, IUCN and

Eduardo Mondlane University.

Existing funders

European Union grant funding (€900,000), money not dedicated to loans within the micro-finance

projects, but instead for training and support as loans come from community-based savings. WWF, Japan Social Development Fund, European Union, Blue Action Fund, Tanzania Informal Microfinance Practitioners.

Kenya: Danida Market Partnership Development; Vest Frost, Total Hospital Solutions, xSolar, WWF Denmark, M-PAYG (mobile pay as you go).

WWF’s role is to

WWF coordinates and supports skill development for the Beach Management Units.

Investment potential

+ Existing pilots of similar initiatives have proven successful.

Social impact

- Financial empowerment (loans accessible with less friction and less paperwork).

- Community building and financial management building.

- Food security.

Environmental impact

- Improved fisheries management.

- Reducing post-catch fish loss: estimated that 1/3 of Kenya’s post-harvest seafood is lost before it can be sold and safely consumed.

- Microfinance loans are conditional on sustainability criteria being met. This differs depending on the use of the loan.

- The increase average price per catch should result in lesser strain on capture fisheries (given quotas and adequate monitoring).

Resource needs and key enablers

- Technical assistance for community co-management.

- Access to mobile money.

Expected profitability

Revenues are generated over the life of the savings scheme (interests on savings/loans) whilst costs

largely only occur at inception for training to financial literacy. The current scheme being

increasingly attractive to local communities, the profitability will rise with the number of users.

Risks and challenges

- Legal: abalone exports are subject to international compliance.

- Security linked to high-end product (theft, crime).

Project scalability

High - Project designed around scalability of proven methods to remaining challenges in East African

SSF communities.

Next steps

- Investigate a for-profit version of the loan scheme, potentially through investing in BMUs.

- Development of digital solutions for fisheries management and Savings Association.

IF YOU ARE INTERESTED IN SUBMITTING A PROJECT OR INVESTING IN ONE OF THE PROJECTS PROFILED ON THIS PLATFORM, THEN PLEASE COMPLETE THIS FORM AND WE WILL BE IN TOUCH SHORTLY.